81% of SMEs in MENA optimistic about future growth guided by potential for digitalization, better data, access to credit and upskilling: Mastercard MEA SME Confidence Index

81%

of SMEs in MENA optimistic about future growth guided by potential for digitalization,

better data, access to credit and upskilling: Mastercard MEA SME Confidence

Index

·

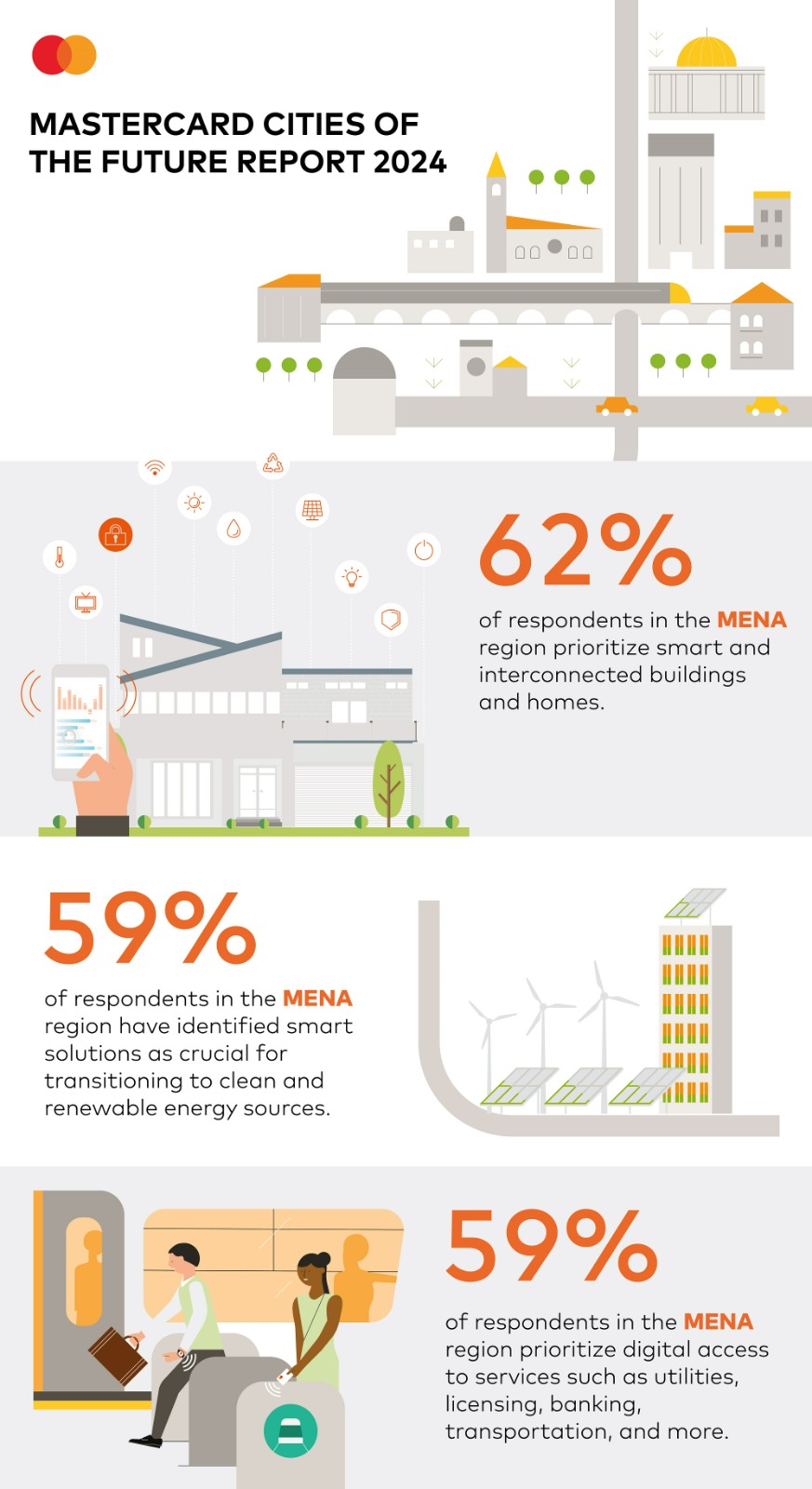

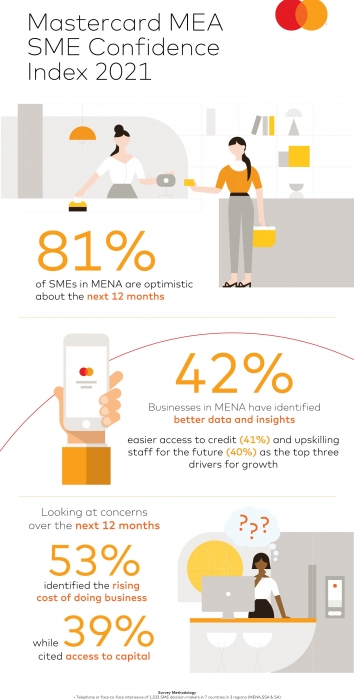

81% of

SMEs in MENA are optimistic about the next 12 months

·

Optimism

in MENA fueled by growth potential of better data, access to credit and

upskilling of staff

·

Research

identified key areas with the greatest potential for growth with half of SMEs

projecting an increase in revenues in the next 12 months

June 27, 2021 | Amman, Jordan – After facing unprecedented changes in the wake of the

COVID-19 pandemic, Small and Medium Enterprise (SME) confidence in MENA is on

the rise, according to the latest research by Mastercard.

The inaugural Mastercard Middle East and

Africa (MEA) SME Confidence Index found 81% of SMEs in MENA are optimistic

about the next 12 months. In fact, 77% are projecting revenues that will either

grow or hold steady. Over half (56%) are projecting an increase.

Access to data, digitalization and skills key

for future growth

As many regional economies gradually enter

the normalization and growth phase, and social restrictions continue to ease,

small and medium sized businesses in MENA have identified better data and

insights (42%), easier access to credit (41%) and upskilling staff (40%), as

the top three drivers for growth. This highlights the opportunities for small

businesses that arise from both internal transformation as well as industry

regulations and trends.

Making sure that SMEs have all the support

they need to go digital and grow digital is a key focus for Mastercard. The

company works closely with government, financial organizations and the wider

business community to create opportunities for SMEs across the region.

Mastercard has pledged $250 million and

committed to connect 50 million micro, small and medium size businesses globally

to the digital economy by 2025 using its technology, network, expertise and

resources in support of the company’s goal of building a more sustainable and

inclusive digital economy. As part of these efforts, Mastercard is focused on

connecting 25 million women entrepreneurs. For many small businesses, reducing

their dependence on cash through digital payments acceptance, has played a

major factor in being able to get paid and maintain revenues.

"The

results from the SME Confidence Index clearly indicates an upliftment in

sentiment that most business across MENA are feeling today. This is a positive

sign for the region on its journey to economic recovery, and a clear indication

of the power of technology in helping enable this growth. As a technology enabler

of choice, Mastercard is working closely with small and medium businesses

across the region to ensure that their needs are being heard and met with the

latest tools and technology that can help them make the most of out of an

evolving digital economy,” said Khalid Elgibali – Division President,

MENA, Mastercard.

The challenge to maintain and grow business a

key concern, whilst public and private partnerships seen as engine for growth

When asked about the main thing that keeps

them up at night, 50% of SMEs in MENA mentioned the challenge to maintain and

grow their business was their top issue. Looking at concerns over the next 12

months, over half (53%) identified the rising cost of doing business, while 39%

cited access to capital. Private sector partnerships (58%) and government-led

initiatives (53%) were identified as having the biggest potential to positively

impact SMEs and the wider MENA market.

"With rising costs among the key concerns of

SMEs in MENA, it is crucial that we prioritize a safe and secure digital

economy that can keep commerce going, enable healthy cash flows, and support

access to capital by virtue of a digital track record. A strong digital economy benefits everyone in multiple ways, from

SMEs being able to grow their customer base through eCommerce, to consumers

having a choice of payment methods. Transforming a smart economy through

technology, insights and omni-channel solutions is how Mastercard supports businesses

of all sizes,” added Elgibali.

As consumer trends evolve in a post-pandemic

world, businesses must adapt and prepare for the future. Mastercard’s Economic Outlook

2021 estimated that 20-30% of the COVID-19 related surge in e-commerce would be

a permanent trend in share of overall retail spending globally. Furthermore,

recent studies from Mastercard showed that 74% of consumers in MENA are

shopping more online than they did since the start of the pandemic and 95% of

the region’s shoppers would consider making a purchase with an emerging payment

technology over the next year.

Ends

Notes to editor:

Survey Methodology:

·

Telephone or face-to-face interviews of 1,533 SME decision-makers in 7 countries

in 3 regions (MENA,SSA & SA)

·

Up to about 300 respondents per country in Kenya, Nigeria, Ivory Coast

and South Africa

·

Up to about 100 respondents per country in Egypt, UAE and KSA

·

Research conducted End of March – End of April (South Africa: until mid-May

2021)

·

Nationally representative sample on SME size

·

Readable sample sizes of:

·

Region clusters

·

SME size, years in business

·

Gender & age of decision-taker

About

Mastercard (NYSE: MA), www.mastercard.com Mastercard is a global technology company in the payments

industry. Our mission is to connect and power an inclusive, digital economy

that benefits everyone, everywhere by making transactions safe, simple, smart

and accessible. Using secure data and networks, partnerships and passion, our

innovations and solutions help individuals, financial institutions, governments

and businesses realize their greatest potential. Our decency quotient, or DQ,

drives our culture and everything we do inside and outside of our company. With

connections across more than 210 countries and territories, we are building a

sustainable world that unlocks priceless possibilities for all.

For further information please contact: rama.alsayegh@mastercard.com